Reverse Mortgages Are An Excellent Hedge Against Property Value Risk – Especially Now

Jack Guttentag Contributor

I write about consumer finance with micro and macro perspectives.

This article is from Forbes. February 17, 2021

Part of the motivation to be a homeowner is the opportunity to accumulate growing equity in a home. Equity growth, however, is heavily influenced by market changes over which the owner has little control. House prices appreciate much more in some areas than in others, and there are some areas in which there is no appreciation at all.

A homeowner reaching 62 can begin converting home equity into spendable funds by taking out a HECM reverse mortgage. In calculating the amounts that a senior can draw using a HECM, the Government assumes the borrower’s house will appreciate by 4% a year. This was the average rate for all areas over a period of many decades.

The individual taking out a HECM reverse mortgage today could experience 4% appreciation, but more likely the rate will be higher or lower. The way the program is designed, the borrower is protected against the adverse consequences of a rate below 4% and allowed to enjoy the benefit of a rate above 4%. The HECM program allows the owner to hedge her property value risk. Here is an example.

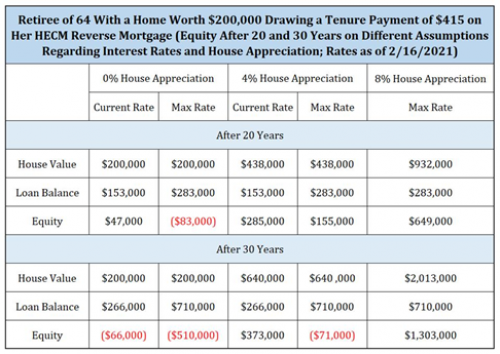

Jane Doe is 64, has a house worth $200,000, and wants to draw the maximum amount possible every month for as long as she lives in the house – called a “tenure payment”. As of February 15, 2021, the largest amount available from any of the 6 lenders who deliver their prices to my web site turns out to be $415 a month.

Now consider the implications of two extreme assumptions about the future value of Jane’s property. In assumption 1, appreciation is zero, meaning the property value remains at $200,000. Jane’s HECM debt, however, rises every month. Assuming the initial interest rate of 2.57% on her reverse mortgage continues, her equity will be reduced to $47,000 after 20 years.

However, there is little chance that the initial rate will hold for 20 years. The more plausible assumption is that the rate will quickly rise to the maximum on her mortgage, which is 7.57%. At that rate, the loan balance after 20 years would exceed the property value by $83,000.

Nonetheless, neither Jane nor her estate will be liable for the deficiency. There are no deficiency judgments in the HECM program. Losses such as the one described above are taken as a charge against the Government’s reserve account, which is replenished by insurance premiums paid by Jane and all other HECM borrowers.

In sum, Jane continues to receive the payment calculated on a 4% appreciation assumption, even though her house has not appreciated at all.

Now consider the implications of an alternative assumption, where Jane’s house appreciates at a rate of 8%. That means that after 20 years, her house will be worth $932,000. Assuming that the interest rate jumps to the maximum, her loan balance would rise to $283,000, resulting in equity of $649,000.

Jane could leave the equity for her estate, or she could convert it into a larger monthly payment by refinancing. That means paying off the balance on the first HECM and drawing a tenure payment on a new HECM. Her new monthly payment would be about $2800, many times larger than the first one, reflecting both the equity growth and Jane’s advanced age.

In sum, the HECM program allows eligible homeowners to benefit from unusually large house price appreciation without bearing the risks associated with low or no appreciation. Unusually low interest rates increase the benefits.

Below Chart Home Equity under various interest rate and appreciation assumptions

About Jack Guttentag

At various times I was Chief of the Domestic Research Division of the Federal Reserve Bank of New York, on the senior staff of the National Bureau of Economic Research, Jacob Safra Professor of International Banking at the Wharton School, and managing editor of the Journal of Finance and the Housing Finance Review. I have also been a consultant to many government agencies and private financial institutions, and a director of the Teachers Insurance and Annuity Association, Federal Home Loan Bank of Pittsburgh, Guild Mortgage Investments, and First Federal Savings and Loan Association of Rochester. In recent years I began to focus my efforts toward helping consumers navigate the home loan market. McGraw Hill published my Mortgage Encyclopedia in 2004, with a second edition in 2010.